CANARA ROBECO LARGE AND MID CAP FUND(CRLMCF)*

Large & Mid Cap Fund - An open ended equity scheme investing in both large cap and mid cap stocks (Formerly Known as Canara Robeco Emerging Equities.)

(as on August 29, 2025)

| SCHEME OBJECTIVE | To generate capital appreciation by investing in a diversified portfolio of large and mid-cap stocks. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | March 11, 2005 |

| BENCHMARK | NIFTY Large Midcap 250 TRI |

| FUND MANAGER | Mr. Amit Nadekar |

| TOTAL EXPERIENCE | 21 Years 19 Years |

| MANAGING THIS FUND | Since 28-Aug-23 Since 01-Oct-19 |

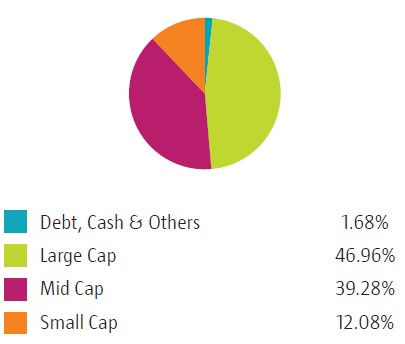

| ASSET ALLOCATION | Large Cap equity and equity related instruments* - 35% to 65%. Mid Cap equity and equity related instruments* - 35% to 65% Other equity and equity related instruments, debt and money market instruments - 0% to 30% Reits/Invits- 0% to 10%. *As defined by Para 2.7.1. of SEBI Master Circular for Mutual Funds dated June 27, 2024, as amended from time to time (Currently it defines Large Cap Companies as those which are ranked from 1 to 100 and Mid Cap Companies as those which are ranked from 101 to 250 based on their full market capitalization) For detailed asset allocation pattern, please refer the Scheme Information Document |

| MINIMUM INVESTMENT | Lump sum Investment: ₹ 5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter Systematic Investment Plan (SIP): For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter Systematic Transfer Plan (STP): For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter Systematic Withdrawal Plan (SWP): For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter For Annual Frequency– ₹ 2,000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| EXIT LOAD | 1% - If redeemed/switched out within 1 year from the date of allotment Nil - if redeemed/switched out after 1 year from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan : 1.60% Direct Plan : 0.56% |

| Month end Assets Under Management (AUM)# | ₹ 25,511.33 Crores |

| Monthly AVG Assets Under Management (AAUM) | ₹ 25,645.08 Crores |

| (as on August 29, 2025) | (₹) |

| Direct Plan - Growth Option | 291.0600 |

| Regular Plan - Growth Option | 253.8900 |

| Regular Plan - IDCW (payout/reinvestment | 86.8000 |

| Direct Plan - IDCW (payout/reinvestment) | 132.2000 |

| Standard Deviation | 14.47 |

| Portfolio Beta | 0.95 |

| Portfolio Turnover Ratio | 0.40 times |

| Sharpe Ratio | 0.72 |

| R-Squared | 0.92 |

| Name of the Instruments | % to NAV |

Equities |

98.32% |

Listed |

98.32% |

Banks |

10.52% |

ICICI Bank Ltd |

6.44% |

Federal Bank Ltd |

2.69% |

State Bank of India |

0.84% |

Indian Bank |

0.54% |

HDFC Bank Ltd |

0.01% |

Leisure Services |

8.44% |

Indian Hotels Co Ltd |

5.71% |

EIH Ltd |

1.93% |

ITC Hotels Ltd |

0.73% |

Devyani International Ltd |

0.07% |

Automobiles |

7.69% |

TVS Motor Co Ltd |

3.79% |

Mahindra & Mahindra Ltd |

2.73% |

Bajaj Auto Ltd |

0.81% |

Tata Motors Ltd |

0.36% |

Retailing |

7.28% |

Eternal Ltd |

3.13% |

Trent Ltd |

2.88% |

Vishal Mega Mart Ltd |

0.84% |

Swiggy Ltd |

0.35% |

Arvind Fashions Ltd |

0.08% |

Auto Components |

7.13% |

Uno Minda Ltd |

4.10% |

Sona Blw Precision Forgings Ltd |

1.09% |

ZF Commercial Vehicle Control Systems India Ltd |

0.69% |

Bharat Forge Ltd |

0.60% |

Schaeffler India Ltd |

0.41% |

Samvardhana Motherson International Ltd |

0.24% |

Consumer Durables |

6.13% |

Dixon Technologies (India) Ltd |

3.55% |

Crompton Greaves Consumer Electricals Ltd |

0.93% |

Bata India Ltd |

0.88% |

Cello World Ltd |

0.33% |

Kajaria Ceramics Ltd |

0.28% |

Berger Paints India Ltd |

0.16% |

IT - Software |

5.58% |

KPIT Technologies Ltd |

3.46% |

Coforge Ltd |

0.92% |

Persistent Systems Ltd |

0.61% |

Tech Mahindra Ltd |

0.36% |

Ltimindtree Ltd |

0.19% |

Mphasis Ltd |

0.04% |

Finance |

4.14% |

Cholamandalam Investment and Finance Co Ltd |

1.91% |

Bajaj Finance Ltd |

1.18% |

Creditaccess Grameen Ltd |

0.91% |

HDB Financial Services Ltd |

0.14% |

Pharmaceuticals & Biotechnology |

3.84% |

Abbott India Ltd |

1.79% |

Ajanta Pharma Ltd |

0.90% |

Sun Pharmaceutical Industries Ltd |

0.72% |

Mankind Pharma Ltd |

0.19% |

Lupin Ltd |

0.16% |

Biocon Ltd |

0.08% |

Electrical Equipment |

3.75% |

ABB India Ltd |

0.95% |

Suzlon Energy Ltd |

0.88% |

Ge Vernova T&D India Ltd |

0.85% |

CG Power and Industrial Solutions Ltd |

0.53% |

Siemens Ltd |

0.17% |

Premier Energies Ltd |

0.16% |

Siemens Energy India ltd |

0.11% |

Thermax Ltd |

0.10% |

Aerospace & Defense |

3.70% |

Bharat Electronics Ltd |

3.32% |

Hindustan Aeronautics Ltd |

0.38% |

Healthcare Services |

3.45% |

Max Healthcare Institute Ltd |

1.87% |

Global Health Ltd |

1.25% |

Dr. Lal Path Labs Ltd |

0.17% |

Syngene International Ltd |

0.16% |

Power |

2.90% |

Tata Power Co Ltd |

1.45% |

Torrent Power Ltd |

1.23% |

NTPC Ltd |

0.22% |

Chemicals & Petrochemicals |

2.46% |

Vinati Organics Ltd |

0.88% |

Pidilite Industries Ltd |

0.68% |

Solar Industries India Ltd |

0.57% |

Deepak Nitrite Ltd |

0.13% |

Linde India Ltd |

0.12% |

Navin Fluorine International Ltd |

0.08% |

Beverages |

2.35% |

United Breweries Ltd |

1.11% |

Varun Beverages Ltd |

0.73% |

Radico Khaitan Ltd |

0.51% |

Industrial Manufacturing |

2.31% |

Praj Industries Ltd |

1.18% |

Kaynes Technology India Ltd |

1.13% |

Capital Markets |

2.27% |

HDFC Asset Management Co Ltd |

0.79% |

Multi Commodity Exchange Of India Ltd |

0.63% |

Central Depository Services (India) Ltd |

0.45% |

Computer Age Management Services Ltd |

0.22% |

BSE Ltd |

0.18% |

Telecom - Services |

2.03% |

Bharti Airtel Ltd |

1.52% |

Bharti Hexacom Ltd |

0.51% |

Agricultural Food & Other Products |

1.96% |

Tata Consumer Products Ltd |

1.96% |

Cement & Cement Products |

1.59% |

J.K. Cement Ltd |

1.24% |

Shree Cement Ltd |

0.35% |

Fertilizers & Agrochemicals |

1.35% |

PI Industries Ltd |

1.35% |

Realty |

1.04% |

Oberoi Realty Ltd |

1.04% |

Paper, Forest & Jute Products |

1.01% |

Aditya Birla Real Estate Ltd |

1.01% |

Diversified |

0.90% |

3M India Ltd |

0.90% |

Food Products |

0.76% |

Britannia Industries Ltd |

0.34% |

Mrs Bectors Food Specialities Ltd |

0.32% |

Nestle India Ltd |

0.10% |

Industrial Products |

0.73% |

APL Apollo Tubes Ltd |

0.50% |

Carborundum Universal Ltd |

0.23% |

Transport Services |

0.73% |

Blue Dart Express Ltd |

0.43% |

TCI Express Ltd |

0.16% |

Container Corporation Of India Ltd |

0.14% |

Financial Technology (Fintech) |

0.56% |

PB Fintech Ltd |

0.56% |

Textiles & Apparels |

0.51% |

K.P.R. Mill Ltd |

0.51% |

Non - Ferrous Metals |

0.42% |

National Aluminium Co Ltd |

0.36% |

Hindustan Zinc Ltd |

0.06% |

Entertainment |

0.25% |

Zee Entertainment Enterprises Ltd |

0.16% |

Tips Music Ltd |

0.09% |

Oil |

0.23% |

Oil India Ltd |

0.23% |

Construction |

0.21% |

KNR Constructions Ltd |

0.21% |

Household Products |

0.10% |

Doms Industries Ltd |

0.10% |

Debt Instruments |

0.05% |

6.00% TVS Motor Co Ltd Non Convertible Redeemable Preference Shares |

0.05% |

Money Market Instruments |

2.12% |

TREPS |

2.12% |

Net Current Assets |

-0.49% |

GRAND TOTAL ( NET ASSET) |

100.00% |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (NIFTY Large Midcap 250 TRI) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 29.08.2025 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.CANARA ROBECO LARGE AND MID CAP FUND**Formerly Known as Canara Robeco Emerging Equities. Please Refer to Notice-cum-Addendum No. 16 dated June 20th, 2025 for Change in Scheme Name

The Scheme and Benchmark riskometers are evaluated on a monthly basis and

the above riskometers are based on the evaluation of the portfolios for the month

ended August 29, 2025.